Tulsa County Assessor John Wright

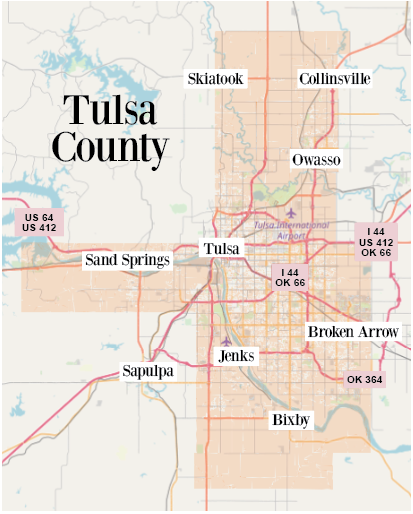

It’s the responsibility of the Tulsa County Assessor’s office to put an accurate, fair market value on all property in Tulsa County, as of the lawful assessment date, with that date being Jan. 1.

According to Assessor John Wright, the reason for this is twofold: One, so that everyone is treated equally, and two, the property assessment is half of what ends up being the property tax bill (the value times the millage rate).

“We’re required by law to notify the people that there has been an increase in the assessment from the previous year, so if we’ve raised the evaluation for tax roll purposes from last year, we send out a notification to the property owner to that effect,” he said. “That notice opens up a 30-day window of appeal, as well as allowing a window of time for people to apply for lawful exemptions.”

Wright’s office is required to look at one-fourth of the county every year, in what’s called the Visual Inspection Cycle, with the county being divided into four roughly even territories, even by virtue of structures being considered. Even the three territories not being visually inspected on a given year are valued, but done so through a market analysis of the sales activity that has taken place in the immediate area.

As a result of this analysis, Wright’s office applies a trending factor, and moves a group of homes to keep them in line with what’s going on in the marketplace, multiplying their assessed value by said trending factor and raising them to be in line with the market.

In the case of Wright’s, his office is less a thermostat, trying to raise the values of the market, than it is a mirror, simply reflecting what the values of the market are indicating.

“There’s a great deal of concern right now about the impact of inflation, and people’s ability to make their budget,” Wright said. “The concern about the impact on property values and how it might affect someone’s property taxes is going to be a concern when we send out our notices.

“That said, there’s a mechanism in the constitution and statutes that constrains the reflection or the raise of property tax values, regardless of what’s happening with the raise in market values,” he said. “If someone has filed for a homestead exemption, the property has to be the individual’s primary residence, they have to be occupying in Jan. 1, their name has to be on the deed – most everybody that’s got an owner-occupied property is going to qualify for a homestead exemption.”

The window of time to file for a homestead exemption, Wright said, is Jan. 1 through March 15 of each year.

“If someone has a homestead exemption, the maximum amount that a property can be increased for tax purposes is 3 percent,” he said. “Most people are hoping that their investment in their home appreciates at least that much, so the people have voted in what we refer to as a cap on the taxable value. In the office, we call this a ‘tax cap’, but it’s better understood (by the public) as a cap on the taxable value of the amount their property can increase for tax roll purposes.”

Wright gave the example that, should the assessed value of a $100,000 house go up to $118,000, for tax roll purposes, it’s only going up to $103,000 (3 percent), if it has a homestead exemption.

Without this exemption, commercial properties, possibly rental or non-owner occupied properties, the cap is still in place but it is a 5 percent cap.

“It’s important that people understand about the cap on the taxable value of their property – we don’t want them to get overly concerned about what’s going to happen in the light of rapidly rising market values,” he said. “Now, we are required to list these properties at what a market evaluation would be, i.e., what is the realistic price that a property might sell for, given an open market transaction.”

Even in an ever-changing market, Wright emphasized that the taxable cap is the friend of the property owner.

“We hope to communicate that if someone has homestead (exemption) filed on their property, for tax roll purposes, the taxable value can only increase 3 percent a year, or 5 percent (without filing for homestead exemption),” he said. “(Property) values are definitely being raised – that reflects what’s going on in the market, but we don’t want the public to be concerned or anxious about this because of the tax cap.”

Even if property values increase from year to year, the cap on the taxable value restricts the increase in property tax 3 to 5 percent, depending upon whether or not a homestead exemption has been filed.

“If someone sells their property or they’re buying a new property, however, the tax caps are removed - it’s a new market transaction,” Wright said. “Additionally, seniors are eligible for a mechanism called the ‘Senior Evaluation Freeze,’ and what is frozen is the taxable value for that property. In other words, if someone’s 65 years or older and meets certain income requirements, they can apply for this and the value that the millage rate, set to the HUD median, is applied to is ‘frozen.’”

But primarily, Wright wants to ensure Tulsa County property owners not to be concerned about rising market values.

“The main thing I want people to understand is the three to 5 percent (increase) applies to everyone except those who’ve purchased a new property,” he said. “The tax cap is their friend.”

For more information, contact the Tulsa County Assessor’s office at 918-596-5100 or visit Assessor.tulsacounty.org.