Mid-Year Market Report Seminar

The Mid-Year Market Report Seminar will address topics including the staggering amount of debt our country has incurred and the fact that high market volatility is now considered the norm.

By: Duane Blankenship | Category: Financial Services | Issue: July 2011

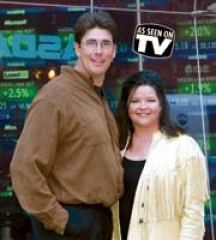

Melanie Hasty-Grant and Ken Grant of Waterstone Private Wealth Management have been frequent contributors to CNBC Powerlunch, FOX Business, BNN, The Wall Street Journal, Reuters, Dow Jones Wire, and Tulsa World.

In addition to managing more than $50 million in client assets, Melanie Hasty-Grant and Ken Grant have been frequent contributors to national and local medias. They bring a middle-America voice of reason to the often-extremist noise of the investment world. The couple owns Waterstone Private Wealth Management, with offices in Owasso and Tulsa at Utica Square. Waterstone clears through the country’s largest independent broker/dealer, LPL Financial.

Waterstone is hosting an exclusive Mid-Year Market Report 2011 Seminar at The Summit Club in Tulsa on Thursday, July 28 from 6 p.m. to 8 p.m. Cost per person is $50. Hors d’oeuvres and cocktails will follow the seminar, and space is limited. “If you’re concerned about gasoline prices continuing to climb, plus market volatility, you need to attend this seminar,” says Melanie.

The Mid-Year Market Report Seminar will address topics including the staggering amount of debt our country has incurred and the fact that high market volatility is now considered the norm. “When huge drops occur in the market, investors need to be prepared with a comprehensive strategy and process already in place. The old ‘buy-and-hold’ approach just doesn’t work any longer because of a perpetually changing market. Continuing to stay saddled up and just ride the market up and down is no longer an effective way to manage your investments.”

Health care, social security, unemployment, and cap and trade continue to be issues of concern, according to Melanie. “If you believe they can and do have an effect on investments, you’re right,” she says.

“Because the market is again on an upward trend, people are starting to feel comfortable, but feeling comfortable often breeds complacency,” says Melanie. Many investors decided to change nothing during the last downturn and “just ride it out.” Waterstone still feels the ride will continue to vacillate upward and downward. “As long as you need money only when the market is ‘up,’ this strategy is fine,” says Melanie. However, most also need income when the market is down. Melanie likes a quote made many years ago by John F. Kennedy, “The time to repair the roof is when the sun is shining.” Although the sun may be shining on the market right now, be on the lookout for future storms. The best time to prepare your investment strategy is now.

Ralph Waldo Emerson once said, “People only see what they are prepared to see.” Waterstone believes that no matter what happens in the market or with the economy, opportunities are available if you look deep enough. Waterstone has the depth of resources to locate the promising opportunities.

“Many have adopted a sense of ‘learned helplessness’ about the market and investments,” explains Melanie. “They don’t know what to do, so they do nothing. Some remain angry at the markets and are afraid to make any decision for fear it will be the wrong one. In reality, the market doesn’t care what you paid for an investment, and the ones you rode down may not be the ones that will ride you back up!” Melanie’s grandmother told her that failing to plan is planning to fail. In reality, making no decision is a decision.

Waterstone urges you to attend the July 28th Mid-Year Market Report Seminar. Get informed. Invite Waterstone to do a stress test on your investments to see how prepared or unprepared you are for varying market environments. “You don’t have to be a victim to the markets any longer,” adds Melanie. Be proactive by seeking a better strategy for the future, stop hoping, and start doing.

For more information, contact

Waterstone Private Wealth Management

(918) 272-1120

About Author Duane Blankenship

Blankenship graduated from the University of Oklahoma and has enjoyed a lifetime career in advertising. He started his own advertising business in 1993 and enjoys creating graphic art and writing. Hobbies include hunting, fishing and pencil drawings. Duane and his wife, Janice, have been married over 50 years and are active in their church and community. He has been a contributing writer for Value News/Values Magazine since 2005.

Waterstone Private Wealth Management

For more information, contact:

Waterstone Private Wealth Management Online:

More about Waterstone Private Wealth Management:

More ArticlesCurrent Coupons/OffersSubscribe

For Free!