Debt Free In 5 Steps

Financially Fit is a column published by RCB Bank to help you gain knowledge on all things financial. RCB Bank professionals share ideas to help you strengthen your money sense, customize savings training, and provide quick and easy action plans to start

By: Jocelyn Wood | Category: Financial Services | Issue: December 2015

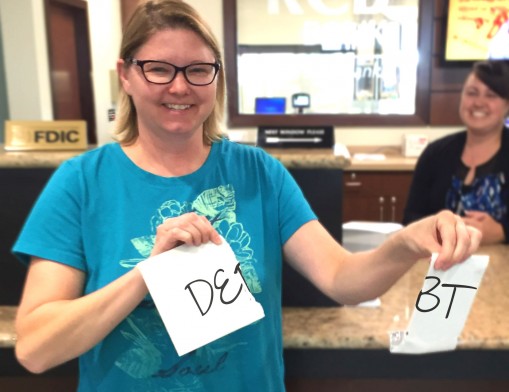

“Being this close feels awesome,” said Michelle Gaviola, nearly debt free after four years of commitment to the snowball process.

Let’s face it; we live in a buy now, pay later society. Credit cards, low interest payment plans, the desire to keep up with the Joneses – the temptation to spend can be intoxicating.

The sobering reality is consumer debt in the United States is nearly $3.4 trillion this year, according to the Federal Reserve. That is $10,200 of debt for every man, woman and child living in the United States. You can get out of debt.

Step 1 – Know what you owe. “You cannot borrow your way out of debt,” said Geoff McGoffin, Market President, RCB Bank. “However, you can better structure your existing debts.” Make a list of all your debts. Figure how much you owe.

Step 2 – Track your spending. “You can’t get out of debt if you don’t know where your money is going,” said Steve Elliott, Loan Officer, RCB Bank. Keep a log of your money. It’s important to account for every penny earned and spent. Most people are shocked at the amount of money spent monthly on fast food lunches, coffee shops and online purchases. Small expenses add up.

Step 3 – Break the cycle. “Pick something routine – your morning coffee stop,” said Ray Simmons, SVP Controller, RCB Bank. “Now, think of a cheaper alternative, like brewing it at home.” Learn to save money while keeping your same lifestyle. If you like to eat out, look for two-for-one deals. Frequent the gym? Switch to a less expensive place.

“Use technology to take the money you save and pay down debts immediately,” said Elliott. “Save $20 eating in; open your credit card app and pay $20 on it right then. The instant gratification of seeing balances fall is very motivating.”

Start paying with cash. Approximately 26 percent of all consumer debt is revolving credit – credit cards. Sixty percent of credit card holders are unable to pay their balances in full.

Step 4 – Pay down debt. “Accumulate small debt victories that will make you feel good and motivate you to continue,” said McGoffin.

Snowball Method – Tackle one debt at a time.

• List all debts in order from smallest to largest.

• Pay minimum payment on all debts while throwing as much money as possible to the smallest debt (e.g. money saved from step 3)

• After the smallest debt is paid, move on to the next smallest debt until debt free. Learn more at daveramsey.com.

Suze Orman Method - Pay a little more than the minimum payment on all debts.

• Pay the minimum balance plus $10 on each debt.

• Take extra money and apply it to the debt with the highest interest rate.

• Pay off debts in order from highest to lowest interest rates. Learn more at suzeorman.com

Step 5 – Reduce expenses and save. “Retirement is just around the corner,” Simmons said. “Managing debt when earnings are no longer increasing is next to impossible. It’s important to start saving now.”

• On payday, pay yourself first; Put money in an account you don’t have ready access to.

• Start an emergency fund for the unexpected; Add $5, $10, whatever you can each month – have a garage sale to start it.

• Look at your current spending habits (steps 1, 2) and cut costs (step 3).

“You have to start somewhere, but the best motivation is personal freedom,” said Victor Casey, Market President, RCB Bank. “Being able to manage your own money and control it how you want is a weight off your shoulders.”

Don’t be afraid to talk to a banker for suggestions on ways to attack your debt situation. At RCB Bank we care about your financial well-being. Stop by to discuss today. RCB Bank, Member FDIC.

RCB Bank

For more information, contact:

RCB Bank Online:

More about RCB Bank:

More ArticlesCurrent Coupons/OffersSubscribe

For Free!